ONE Campaign, a global organisation campaigning to end extreme poverty and preventable disease by 2030, has called on the government, donors and investors to make African agricultural productivity a priority to ensure food security on the continent.

The 2021 Global Report on Food Crises estimated that about 155 million people are living in severe hunger globally.

It noted that about 63 per cent of this chunk live in Africa, with Central and Southern Africa accounting for 40.4 million.

Edwin Ikhuoria, Africa Executive Director at the ONE Campaign, said the COVID-19 outbreak, the war between Ukraine and Russia, and global warming have led to loss of jobs and an increase in the number of hungry people on the African continent.

“More than twice the population of the United States in Africa go to bed hungry on a regular basis even before the COVID-19 outbreak; this is not a new problem,” Mr Ikhuoria said in a statement.

“As the virus spread, Africa’s already-tight economy crumbled under the strain, resulting in the loss of thousands of jobs and a consequent rise in the number of hungry people. As a result of the Russian-Ukrainian conflict and global warming, food supply, demand, and prices are all in flux. Africa is still grappling with the aftershocks of the pandemic, but self-sufficiency in food production is more crucial than ever for the continent.”

He called on governments, donors, private businesses, and investors to prioritise agricultural productivity in Africa. This, he said, will lead to food self sufficiency for the continent, saying “self sufficiency is the only solution for a continent in crisis”.

He noted that while some countries are taking steps towards self-sufficiency, it could be counterproductive if the environment is not suitable for small-scale producers.

Mr Ikhuoria, therefore, advocated the provision of technologies, finances and land for farmers.

He said: “Ethiopia stands out in their journey to becoming self-reliant. With the support of the African Development Bank’s Agricultural Technologies for African Agricultural Transformation Programme, Ethiopia will not import grain in 2022. This should be the trajectory for all African states.

“Investing today in the creation of cross-border food systems and institutions will help the entire world in the near future by unlocking Africa’s potential to feed itself and become the food basket of the world.”

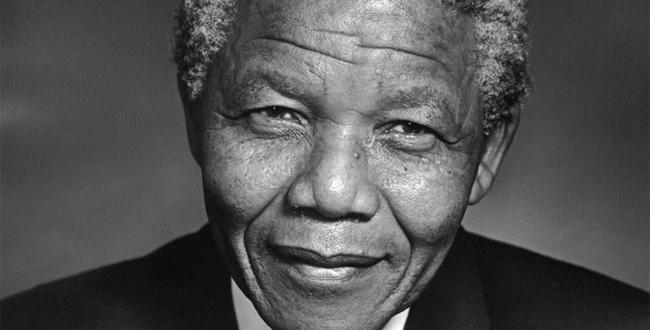

“Food security is not an issue that should be addressed by individual nations on the continent. In order to expedite the creation of a continent-wide strategy that would aid in enhancing climate change resilience and developing sustainable agricultural systems, more transnational political relations and information sharing are required. In turn, this will produce a future defined by cooperation and coordination, fostering the development of a continent described by Nelson Mandela as “an Africa where there is work, bread, water, and salt for all.”

Mandela Day

In commemorating Mandela Day 2022, ONE recalled the iconic words of the late Nelson Mandela about food security.

READ ALSO: Nelson Mandela Day: 2Baba, Amanda Black, other African artists release ‘Stand Together’ song

“It’s not only about producing more food, but about making the political commitment to ensure that people have the means and services they need to buy or create enough safe and nutritious food,” Nobel Peace Prize Laureate Nelson Mandela said.

In 2009, the United Nations declared every 18th of July, Mandela’s birthday, as a day for all to take action and inspire change.

In a message to commemorate the day, the UN Secretary General, Antonio Gutteres, called for an end to racism, discimination, poverty and inequalities.

He said: “Our world today is marred by war; overwhelmed by emergencies; blighted by racism, discrimination, poverty, and inequalities; and threatened by climate disaster. Let us find hope in Nelson Mandela’s example and inspiration in his vision.

“Today and every day, let us honour Nelson Mandela’s legacy by taking action. By speaking out against hate and standing up for human rights. By embracing our common humanity – rich in diversity, equal in dignity, united in solidarity. And by together making our world more just, compassionate, prosperous, and sustainable for all.”

Qosim Suleiman is a reporter at Premium Times in partnership with Report for the World, which matches local newsrooms with talented emerging journalists to report on under-covered issues around the globe.

Support PREMIUM TIMES’ journalism of integrity and credibility

Good journalism costs a lot of money. Yet only good journalism can ensure the possibility of a good society, an accountable democracy, and a transparent government.

For continued free access to the best investigative journalism in the country we ask you to consider making a modest support to this noble endeavour.

By contributing to PREMIUM TIMES, you are helping to sustain a journalism of relevance and ensuring it remains free and available to all.

Donate

TEXT AD: Call Willie – +2348098788999